All eyes continue to be on the banking sector in the US and Europe. So far, regulators seem to have averted a full-blown financial system contagion and collapse. In Switzerland,

Tag: SSB

What a week it’s been! Silicon Valley Bank and Signature Bank have both gone bust. First Republic Bank is on the brink but seems to have backing from other big

Sharing my own research of fixed income options since interest rates have increased to a point that cash can actually get pretty decent yields. I’ve been on a drive to

The latest SSB for April 2023 has been announced with a 10-year average yield of 3.15%, an increase from last month’s SSB offering 2.9%. The first year yield is 3.01%.

The latest SSB for March 2023 has been announced with a 10 year average yield of 2.9%, down quite a bit from the peak of 3.47% for the Dec 2022

Stocks are racing off the mark strongly in 2023. US stocks have been rallying on expectations that the Fed hiking cycle might be nearing the end. Chinese stocks likewise have

New month, same question: Should I rollover any older SSB issuances for the latest one? A key consideration is whether next month’s bond for Mar SSB will offer higher or

Unfortunately, we didn’t get a Santa rally to cheer us up for the holidays. December ended deep in the red, and took our portfolio down with it. The Family Portfolio

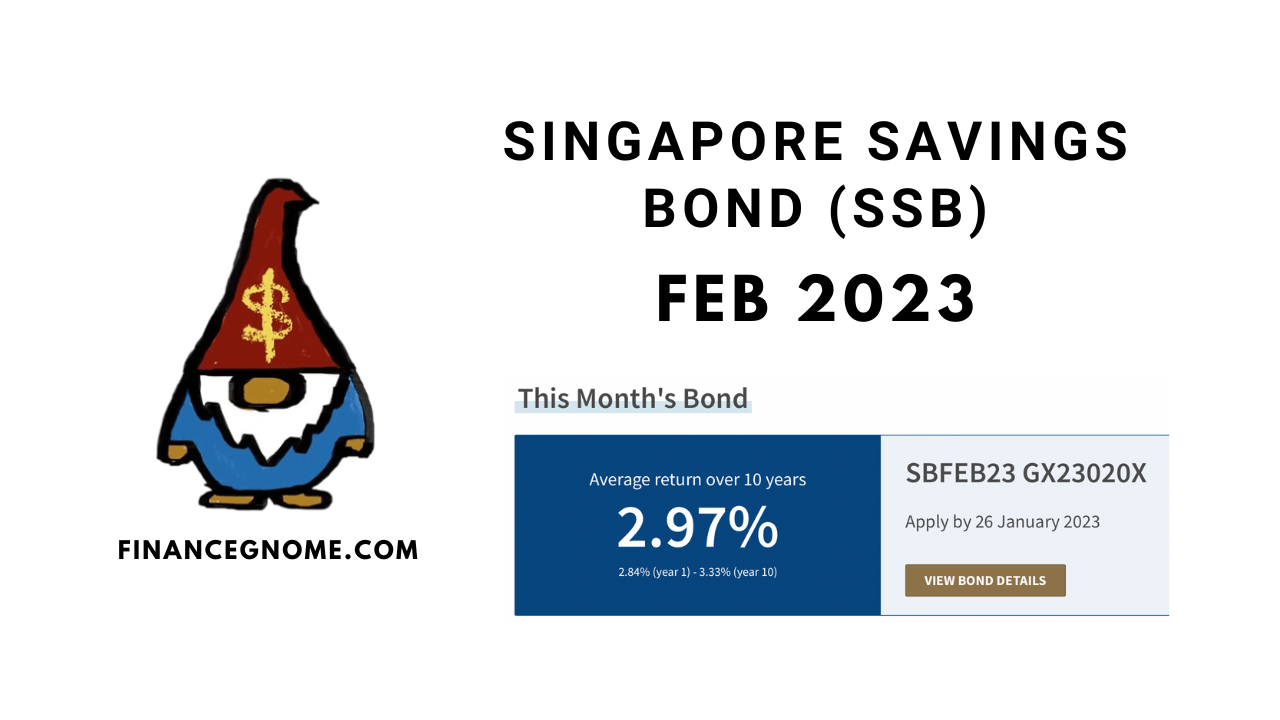

The latest SSB for Feb 2023 has been announced with a 10 year average yield of 2.97%, down quite a bit from the peak of 3.47% for the Dec 2022

Based on allotment results for SSB Jan 2023, demand for SSBs are unwinding. This round, SSB was only oversubscribed by a hair (around 1% oversubscribed only). Most people got fully