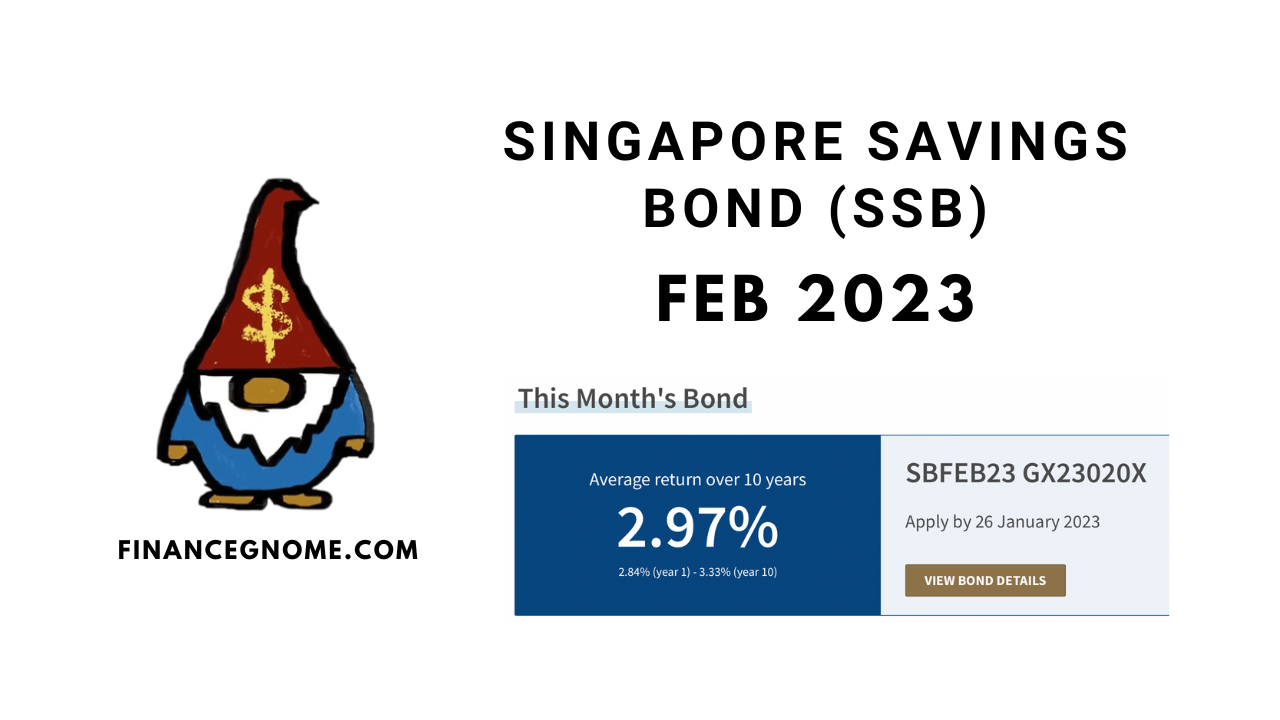

The latest SSB for Feb 2023 has been announced with a 10 year average yield of 2.97%, down quite a bit from the peak of 3.47% for the Dec 2022 issuance.

If you’re looking for places to park your cash or SRS funds, SSB could be a good option. Unfortunately, SSB is not eligible for CPFIS scheme so you can’t invest your CPF savings into it.

For more details, refer to my Singapore Savings Bond (SSB) tracker page here.

Alternatives offer higher yields

Treasury bills or T-bills, fixed deposits, and even some bank savings accounts offer higher yields than SSB at the moment. Most cash funds and short-term bonds now offer around 4% yield.

For example, the last 6-month T-bill had cut-off yield of 4.28%. There’s a tranche now open for auction on 5th Jan 2023 if you’re interested to put in a bid.

For fixed deposits, CIMB is offering up to 4.2% (preferred banking), OCBC offering up to 4.08% (OCBC 360 customers), and UOB offering up to 3.95% (>$1 million placement).

As for cash funds, MoneyOwl WiseSaver is offering 3.84% 5-day MA yield, but this rate fluctuates daily.

Bank savings accounts are also offering very attractive yields but require you to jump through hoops to get there. For instance, Standard Chartered has recently increased this interest rate on Bonus$aver account, depending on which criteria you fulfil.

With SSB only yielding slightly below 3%, is it still worth considering?

Why is SSB yield relatively so low?

SSB yield is based on the average of daily 10 year SGS bond yields in the prior month. Then, the yield each year is calculated so that it steps up every year and eventually yields the 10-year average of the SSB. This step up feature though is currently restricting the short-term yields from increasing to the actual short-term bond yields. What’s worse is that longer-term bond yields are falling further, dragging SSB yields with them.

So for SSB, the short-term yields are capped at 2.84% for the first few years for Feb 2023 issuance, even though 1Y SGS bond is yielding 4.2%.

Why SSB might still be worth applying for

The main attraction of SSB in my opinion, is the long tenure yet having the flexibility to redeem early without penalty.

Fed funds rate has spiked very quickly and usually goes back down in a recession, which many are expecting this year or next. If interest rates start to reverse back downwards, you might not be able to find similar high yields when your T-bill or fixed deposit matures. If you’re in cash fund or savings account, at least you might be able to redeploy it quickly elsewhere, maybe into SSB at short notice.

SSB offers the flexibility to redeem early without penalty. You’d also still be entitled to accrued interest upon redemption. So if interest rates continue to rise, you have the option of redeeming earlier bonds and applying for the latest issuance with higher interest rates.

My thoughts

If you hold the view that yields will continue to rise 6-12 months from now, T-bills or FD might be a better option. Personally, I think rates will remain high this year. SGS 10Y bonds were falling but has recently bottomed around 2.9% and are going back up. The Fed has also indicated that they still have a few more rate hikes to go before reaching their terminal rate of around 5.1%.

However, there’s always risk that things don’t pan out as the Fed predicts. There’s the possibility that inflation eases or the economy deteriorates faster than expected, forcing the Fed to pivot earlier than expected. Personally, I don’t think this will happen, but I would still want to hedge for that possibility. So, I think locking in some SSB for the next 10 years, despite lower rates might still make sense.

Another consideration is if you’re holding older lower-yielding SSB issuances, you might want to consider rolling some over more aggressively, since demand for SSB seems to be cooling off and you can probably secure larger allotments. Seems like most people have been redeeming issuances for May 2022 or before. From the data below from MAS website, seems like only June 2022 issuances onwards might be worth holding on to. Personally, I’ve redeemed all my July and Oct 2022 issuances which were yielding around 2.7%.

Am I applying this round?

Currently, I’m fully allotted for SSB at $60k after last month’s SSB. My lowest yielding tranche is $13k worth of Sep 2022 SSB @ 2.80%. I feel that rolling over to 2.97% might not be worth the effort, so I’ll probably sit this round out. Hopefully next month’s SSB will be well above 3%, which will make it more attractive to roll those Sep 2022 SSBs over.

In the meantime, I will be putting any excess cash into fixed deposits, cash funds and/or savings accounts to take advantage of the high short-term yields.

Read also: Don’t Miss Out On Yield On Your Idle Cash

Are you applying for SSB this month?

Follow me on Facebook, Telegram, Twitter and Youtube.

Disclaimer: This is not financial advice. I am not professional financial advisor nor do I work in the finance industry. Anything I write here is purely my personal opinion. Please do your own research and due diligence before investing into anything. All investments come with associated risks. Best to consult a financial advisor if you’re still unsure.

Download my FREE Ebook: How to Start Investing in Stocks for Beginners

For more investing tips, visit my Guide page.

- Standard Chartered Online Trading: Referral link

- FSMOne: Referral code P0267058

- Tiger Brokers: Referral link | Review

- Futu SG (moomoo app): Referral link | Review

- Webull: Referral link

- Syfe Wealth & Syfe Trade: Referral code FINANCEGNOME | Referral link | Review

- Endowus: Referral code J5HPB | Referral link

- CoinHako: Referral link

- Crypto.com: Referral link

- Portseido: Referral link

For more investing resources, see my Referrals page.

Disclosure: This post may contain affiliate links and I may get a commission when you click on the links or open an account through the links, at no additional cost to you. I only recommend products or services that I have personally tried and have found useful.