CapitaLand Ascott Trust (CLAS) (SGX:HMN) reported Q4 and FY 2022 results on 30 Jan 2023, which were green across the board. CLAS reported 80% increase in 2H 2022 gross profit

Microsoft (MSFT) results for Q4 2022 (FY23 Q2) released on 24th Jan 2023. MSFT stock jumped ~5% initially after results release but reversed down ~3% after management offered weak guidance

Tesla (TSLA) surged almost +11% day after results (27 Jan) after reporting Q4 2022 earnings (26 Jan) after market close. Tesla beat on both revenue and EPS, but guided for

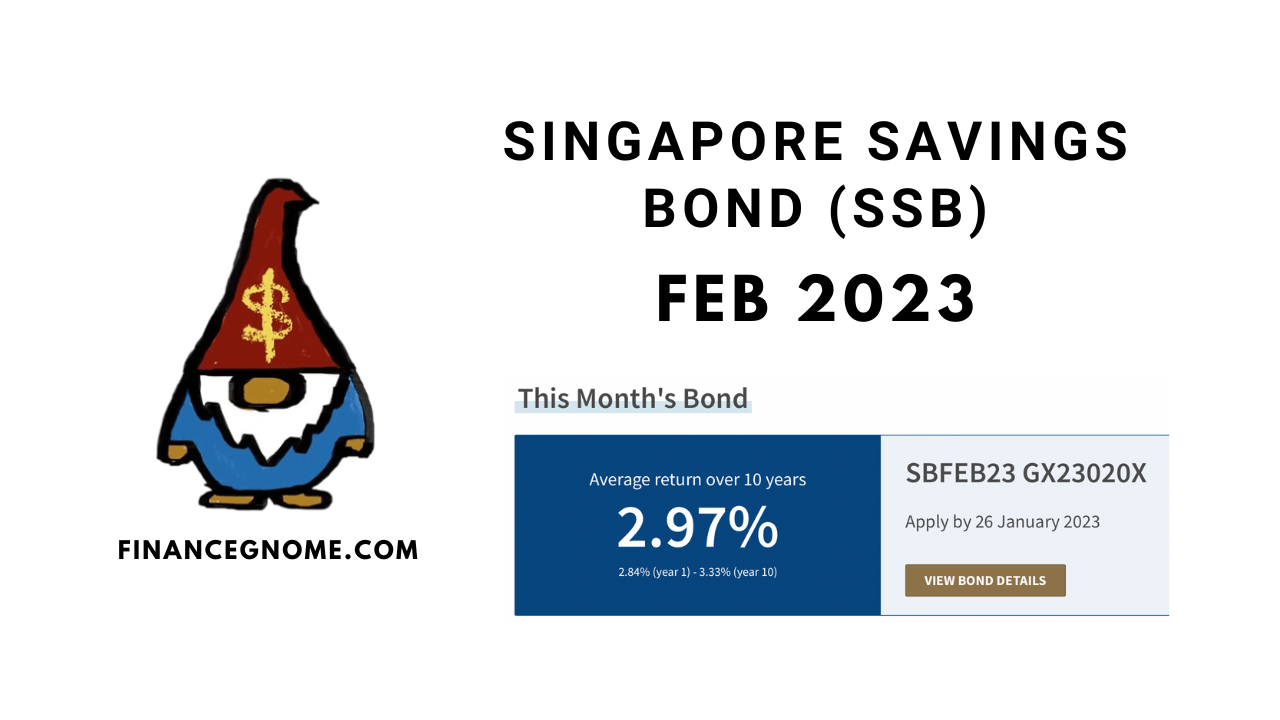

New month, same question: Should I rollover any older SSB issuances for the latest one? A key consideration is whether next month’s bond for Mar SSB will offer higher or

Following up on my previous post reviewing Wealth and Portfolio goals, I’ve also been reflecting about other aspects of life (after all, life is not all about money, right?). Read

Choosing the best bank savings account might seem like the simplest and lowest hanging fruit but I’ve actually found it to be the more complicated to optimise than I thought.

In the spirit of the new year and setting resolutions or goals for 2023, I’ve compiled the basics that I think every new stock investor should know to get started

Unfortunately, we didn’t get a Santa rally to cheer us up for the holidays. December ended deep in the red, and took our portfolio down with it. The Family Portfolio

The latest SSB for Feb 2023 has been announced with a 10 year average yield of 2.97%, down quite a bit from the peak of 3.47% for the Dec 2022

2022 has not been a kind year financially. In terms of the investment portfolio, definitely a year I would like to forget. But then again, the lessons learnt might prove