Choosing the best bank savings account might seem like the simplest and lowest hanging fruit but I’ve actually found it to be the more complicated to optimise than I thought.

Category: Singapore Market

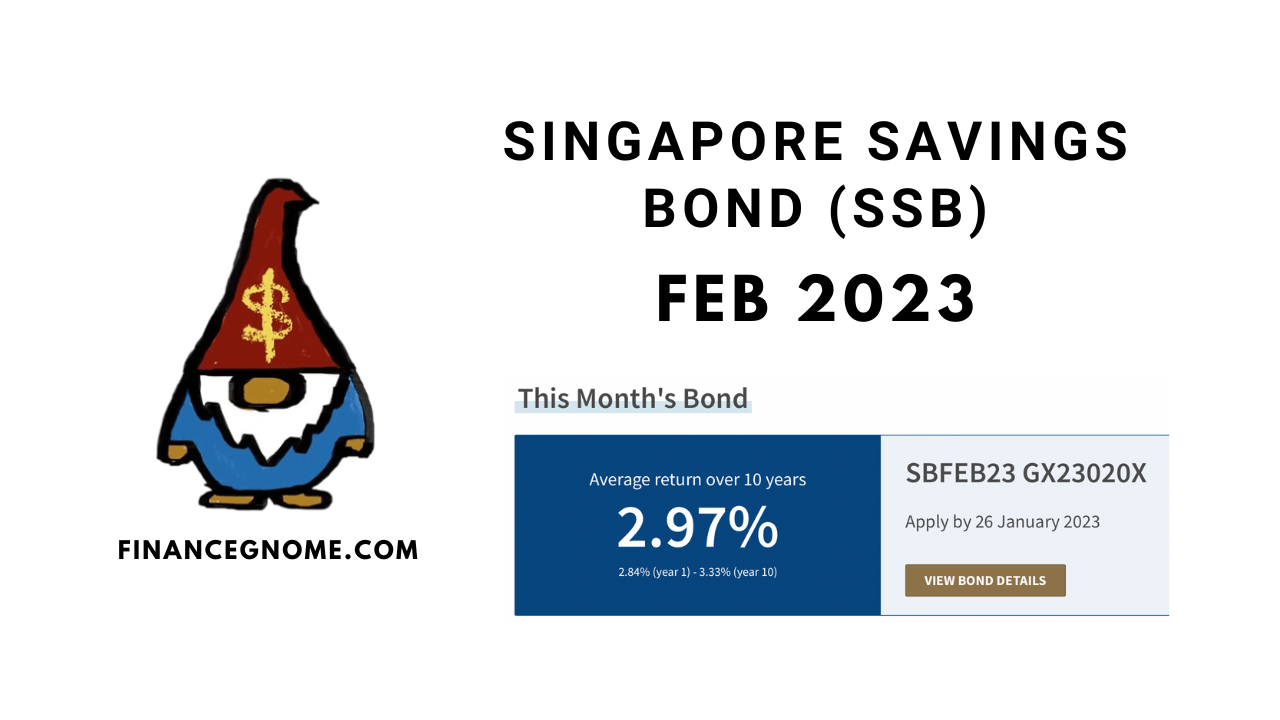

The latest SSB for Feb 2023 has been announced with a 10 year average yield of 2.97%, down quite a bit from the peak of 3.47% for the Dec 2022

Based on allotment results for SSB Jan 2023, demand for SSBs are unwinding. This round, SSB was only oversubscribed by a hair (around 1% oversubscribed only). Most people got fully

With so many compelling options to park cash right now yielding around 4%, holding onto previous SSB tranches yielding below 3% comes at an opportunity cost. Even this month’s SSB

If you have idle cash sitting in brokerage accounts waiting for buying opportunities, you might be missing out on yield you could be getting from cash funds. With inflation running

Singapore Government Securities (SGS) 10-year bond yields, of which Singapore Savings Bond (SSB) yields are based upon, have resumed their fall so far in Dec 2022 and have recently sunk

Most Singapore banks have been revising their interest rates on savings accounts upwards in tandem with rising global interest rates. Previously, salary crediting didn’t earn you much extra interest but

Standard Chartered (SC) Online Trading is the online broker arm of Standard Chartered Bank Singapore Limited (SCBSL). I’m not sure how long SC Online Trading has been around, but SCBSL

Wow! Everyone gets up to $14k allotment for Dec SSB despite the yield hitting record highs. Imagine my surprise that demand has cooled quite a bit, although still oversubscribed by

CSOP iEdge S-REIT Leaders Index ETF (SGX:SRT/SRU) is one of the 5 REIT ETFs listed on SGX. If you’re looking to invest in Singapore REITs or S-REITs but unsure of