Syfe has recently launched Income+ portfolios which offer investors yet another high-yield fixed income option in Singapore. These Income+ portfolios (Preserve and Enhance) are offered in partnership with PIMCO which

Author: Calvin Lo

Singapore robo-advisors Syfe, Endowus, and StashAway have reported their Q1 2023 performance. Let’s see how they stacked up against each other, and who came out on top. Benchmark: MSCI World

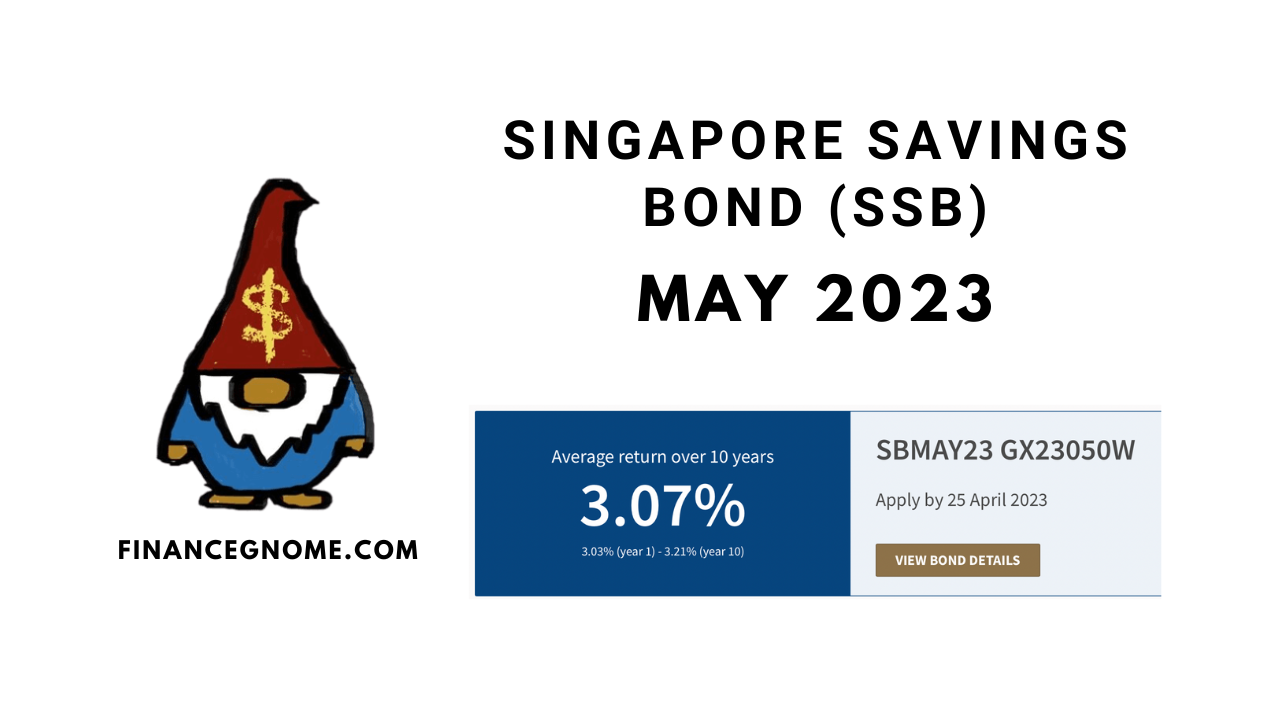

The latest SSB for May 2023 has been announced with a 10-year average yield of 3.07%, a slight decrease from last month’s SSB offering 3.15%. The first year yield is

I’ve just updated my Fixed Income Tracker for April 2023. Changes this month: My thoughts:

Recently, I decided to move some money out of my Tiger Brokers (TB) account back into our Standard Chartered Online Trading (SCOT) joint account. Since the Vanguard Total World Stock

It’s the end of the Q1 already! Markets raced upwards to end the quarter strong, especially for the tech-heavy Nasdaq. Family portfolio performed largely in line with S&P 500, but

Endowus just had a webinar for the launch of 2 low-cost passive index funds by Amundi asset management for CPF investment. Note that these 2 funds were already available for

Syfe just updated via email that they will be rebalancing REIT+ portfolio in line with the semi-annual review of iEdge S-REIT Leaders Index for March 2023. Rebalancing will be completed

What a week it’s been! Silicon Valley Bank and Signature Bank have both gone bust. First Republic Bank is on the brink but seems to have backing from other big