With so many compelling options to park cash right now yielding around 4%, holding onto previous SSB tranches yielding below 3% comes at an opportunity cost. Even this month’s SSB

Tag: SSB

Singapore Government Securities (SGS) 10-year bond yields, of which Singapore Savings Bond (SSB) yields are based upon, have resumed their fall so far in Dec 2022 and have recently sunk

With stocks in decline for a year now and both savings accounts and bonds yields increasing, there’s little incentive to take higher risks in the stock market. Naturally, interest in

November was nice green month in markets, with all 3 U.S. indices DJIA, S&P 500 and Nasdaq 100 up around +6%. Stocks got a boost from better than expected U.S.

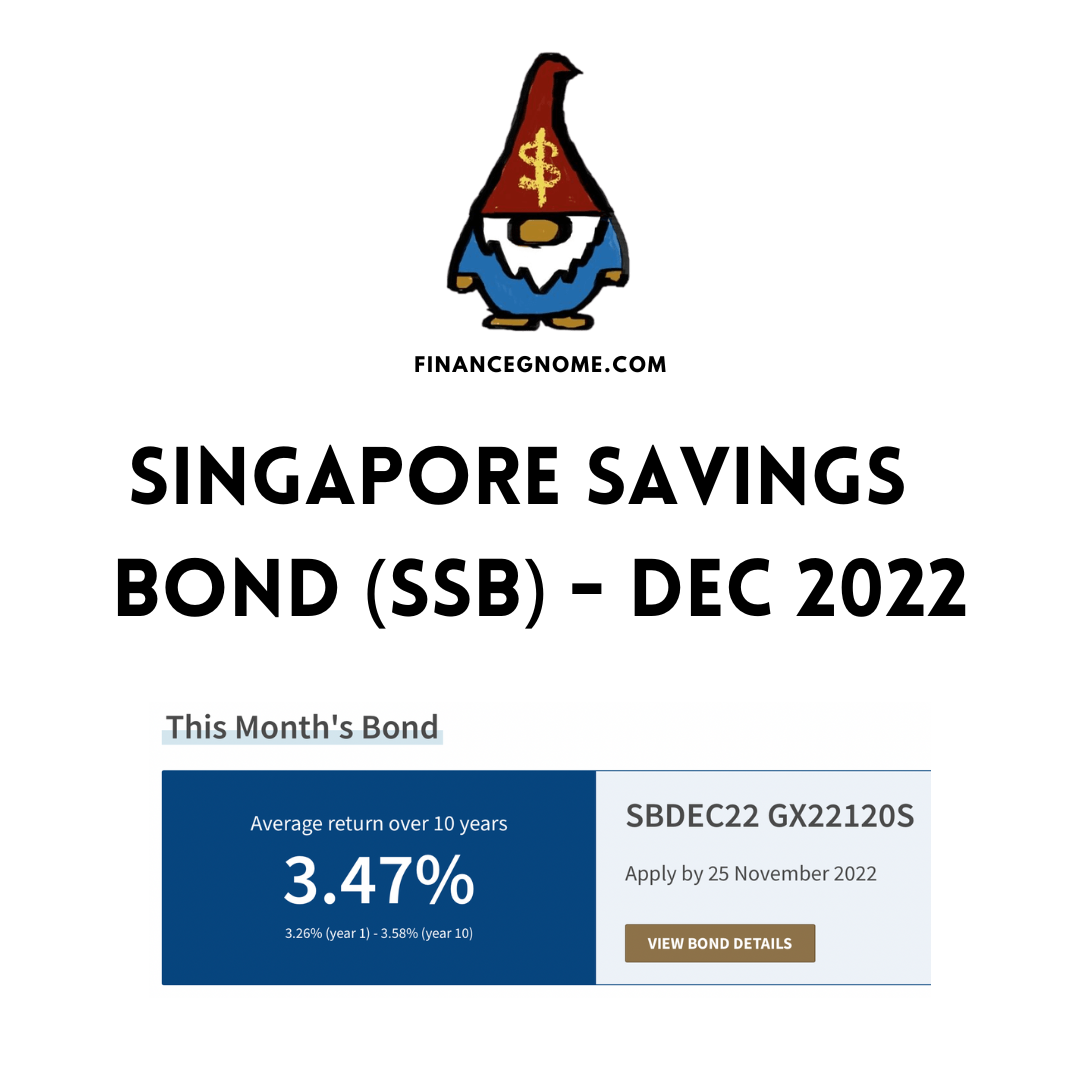

Wow! Everyone gets up to $14k allotment for Dec SSB despite the yield hitting record highs. Imagine my surprise that demand has cooled quite a bit, although still oversubscribed by

10-year SGS bond yields have been falling since U.S. Oct CPI was reported on 10th Nov 2022, as expectations of the Fed slowing interest rate hikes has increased. 10Y SGS

Yet another record high for Dec 2022 SSB of 3.47% average 10-year yield! Even the first year yield is a juicy 3.26%. If you’re looking for places to park your

Stocks ended October in the green although the performance was pretty uneven among sectors. Value stocks outperformed, as shown by DJIA up +14% MoM vs S&P 500 up +8% and

SSB Nov 2022 allotment results are out. Demand was high unsurprisingly, with this round being oversubscribed by more than 2x. Everyone who applied gets at least $10K. The lucky 29%

Nov 2022 SSB has hit another high so far this year of 3.21% average 10-year yield! The SSB yield curve has continued to flatten, with first year yield at 3.08%.