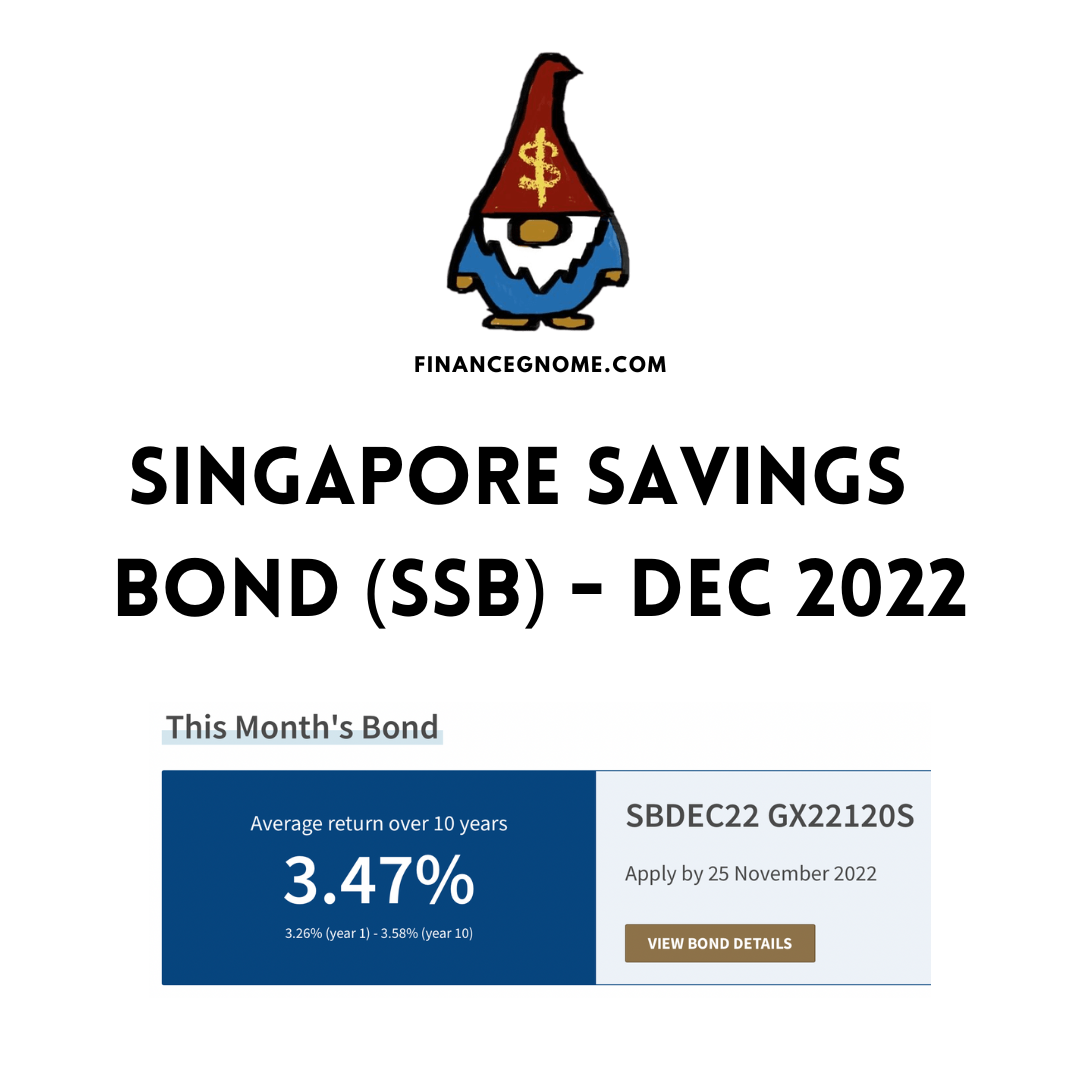

Yet another record high for Dec 2022 SSB of 3.47% average 10-year yield! Even the first year yield is a juicy 3.26%. If you’re looking for places to park your cash or SRS funds, SSB could be a good option. Unfortunately, SSB is not eligible for CPFIS scheme so you can’t invest your CPF savings into it.

For more details, refer to my Singapore Savings Bond (SSB) tracker page here.

Bonds yields still rising

The US Federal Reserve just raised interest rates by another 75 bps as expected at their FOMC meeting this month on 2nd Nov 2022.

According to the CME FedWatch Tool, the market is pretty split on a 50 bps or 75 bps at next month’s FOMC meeting but a rate hike is 100% expected.

Thus, we can reasonably expect SGS bond yields to continue on its current uptrend, at least for shorter term tenures. For longer term ones like the 10-year might increase at slower pace as fears of recession increase.

SSB offers the flexibility to redeem early without penalty. You’d also still be entitled to accrued interest upon redemption. So if interest rates continue to rise, you have the option of redeeming earlier bonds and applying for the latest issuance with higher interest rates.

Can SSB yield curve invert?

What I’m curious about is whether SSB yields over the 10-year period can invert like the US treasury yield curve, which has been inverter for some time now. I’ve been tracking SSB yields since the start of the year, and the yield curve has been flattening more and more.

The (original) idea of SSB is to have step up interest as you hold for longer. However, with short term rates rising faster than long term rates, SSB yield curve might be reaching a breaking point unless the short term rates are capped. If you have any insight or thoughts on this, I’m interested to hear them.

SSB or T-bill?

I don’t track T-bill yields over time but the last 6m T-bill cut-off yield was a whooping 4.19%. That’s a spread of slightly less than 1% vs SSB first year yield (I think it’s not fair to compare vs 10 year yield).

If you want to max out yield in the short term, T-bills might be better but if you want to lock in rates for longer, you might want to go with SSB instead.

Another consideration is if you have a lot of capital to deploy quickly, e.g. >$20k, you may need to consider T-bills since the total amount offered is usually much higher giving you a higher chance to be fully allotted. For this month’s SSB, I’d be happy to get $10k even in view of the high yield.

If you’re looking to invest your CPF, there’s no comparison necessary because you can’t apply for SSB with CPF savings, only T-bill can.

Am I applying?

Personally, I still prefer SSB as the best option to park my emergency funds or idle funds despite the lower yield vs T-bills. I prefer to lock in rates for longer and I’m a bit lazy to monitor and re-apply T-bill next round upon maturity. If I want to secure higher yields on SSB in subsequent issues, I will just redeem earlier lower yielding issuances and roll the money into newer ones.

Last month, I managed to get $10k Nov SSB @ 3.21% and concurrently redeemed $10k July SSB @ 2.71%. So, I got an additional +40 bps.

This month, I have still have $10k to deploy and I also plan to roll another $8k remainder from my July SSB. To support the roll, I’m using cash buffer from investment funds since I’m intentionally building up cash reserves anyway to deploy into stocks later when the time is right (whatever that means).

Are you applying for SSB or T-bills this month?

Follow me on Facebook, Telegram, Twitter and Youtube.

Disclaimer: This is not financial advice. I am not professional financial advisor nor do I work in the finance industry. Anything I write here is purely my personal opinion. Please do your own research and due diligence before investing into anything. All investments come with associated risks. Best to consult a financial advisor if you’re still unsure.

Download my FREE Ebook: How to Start Investing in Stocks for Beginners

For more investing tips, visit my Guide page.

- Standard Chartered Online Trading: Referral link

- FSMOne: Referral code P0267058

- Tiger Brokers: Referral link | Review

- Futu SG (moomoo app): Referral link | Review

- Webull: Referral link

- Syfe Wealth & Syfe Trade: Referral code FINANCEGNOME | Referral link | Review

- Endowus: Referral code J5HPB | Referral link

- CoinHako: Referral link

- Crypto.com: Referral link

- Portseido: Referral link

For more investing resources, see my Referrals page.

Disclosure: This post may contain affiliate links and I may get a commission when you click on the links or open an account through the links, at no additional cost to you. I only recommend products or services that I have personally tried and have found useful.

2 thoughts on “Singapore Savings Bond (SSB) Dec 2022 – Record High 3.47% Yield!”

Comments are closed.