November was nice green month in markets, with all 3 U.S. indices DJIA, S&P 500 and Nasdaq 100 up around +6%. Stocks got a boost from better than expected U.S.

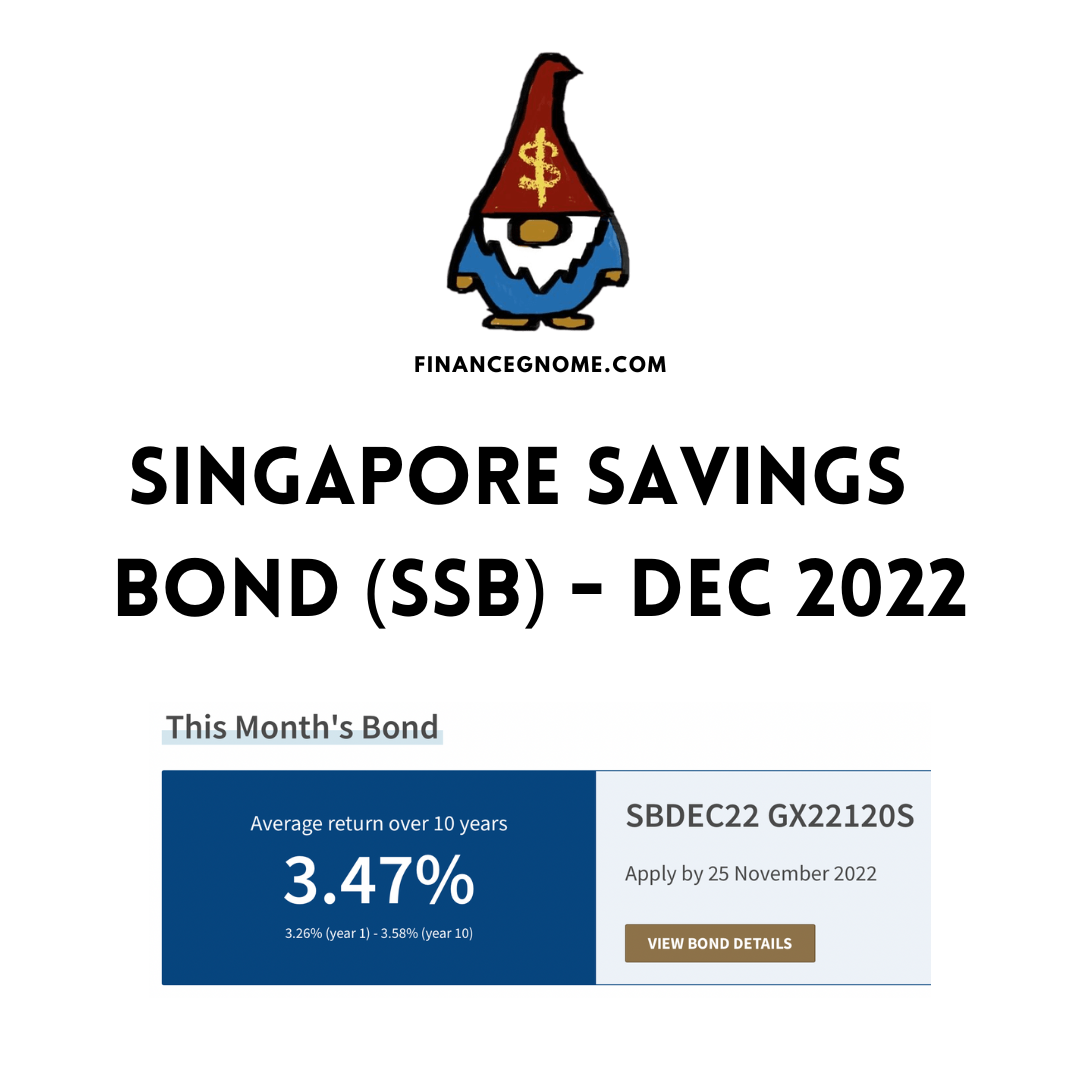

Wow! Everyone gets up to $14k allotment for Dec SSB despite the yield hitting record highs. Imagine my surprise that demand has cooled quite a bit, although still oversubscribed by

CSOP iEdge S-REIT Leaders Index ETF (SGX:SRT/SRU) is one of the 5 REIT ETFs listed on SGX. If you’re looking to invest in Singapore REITs or S-REITs but unsure of

10-year SGS bond yields have been falling since U.S. Oct CPI was reported on 10th Nov 2022, as expectations of the Fed slowing interest rate hikes has increased. 10Y SGS

In this era, there are many ETFs (exchange-traded funds) covering different asset class, investing styles, themes, sectors, and geographies. Adding to the complexities are tax implications for investing in ETFs

FTX has officially filed for Chapter 11 bankruptcy protection, sparking chaos in the crypto world. Everyone seems to be scrambling to withdraw their crypto off centralised exchanges or even just

FTX was not the first pin to fall but it might be the most important one so far. FTX was the 3rd largest crypto exchange, so for it to fail

Many investors have been rotating into dividend and value stocks this year as growth stocks have taken a massive beating. Are you looking to buy dividend stocks? If so, you

The longer I’m invested and the more I learn about investing, I’m increasingly convinced that I should not be actively trading my retirement portfolio. I suspect the same might be

Yet another record high for Dec 2022 SSB of 3.47% average 10-year yield! Even the first year yield is a juicy 3.26%. If you’re looking for places to park your