10-year SGS bond yields have been falling since U.S. Oct CPI was reported on 10th Nov 2022, as expectations of the Fed slowing interest rate hikes has increased. 10Y SGS

Category: Singapore Market

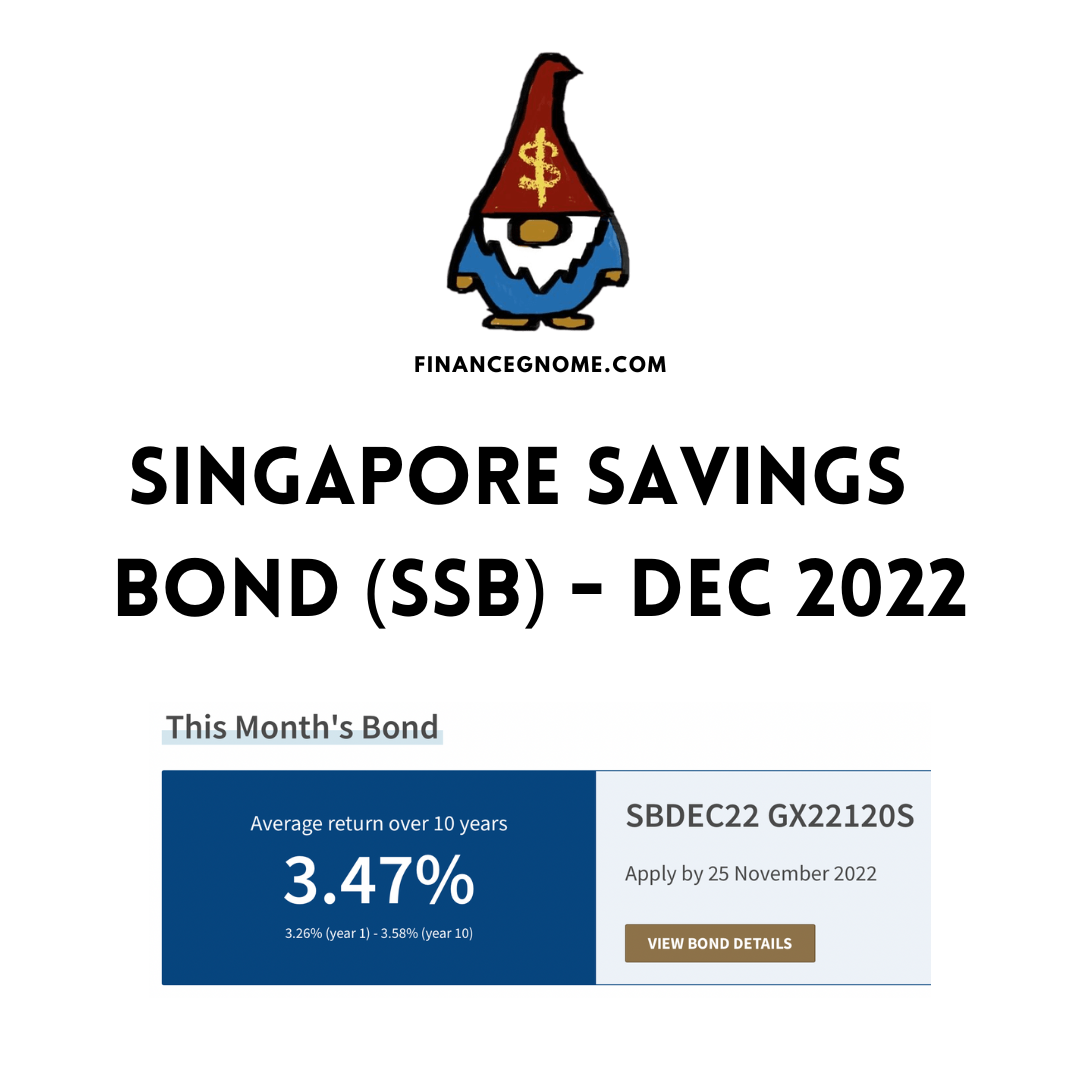

Yet another record high for Dec 2022 SSB of 3.47% average 10-year yield! Even the first year yield is a juicy 3.26%. If you’re looking for places to park your

SSB Nov 2022 allotment results are out. Demand was high unsurprisingly, with this round being oversubscribed by more than 2x. Everyone who applied gets at least $10K. The lucky 29%

I just received an email from Syfe informing clients about a few re-optimisation actions taken on Core portfolios as part of Syfe’s semi-annual exercise. Key changes in this re-optimisation exercise:

Nov 2022 SSB has hit another high so far this year of 3.21% average 10-year yield! The SSB yield curve has continued to flatten, with first year yield at 3.08%.

Over the past few months, I’ve been looking for the best option (for me) in Singapore to invest in REITs. I wanted a passive, simple and affordable way to gain

Syfe just updated via email about a rebalancing of REIT+ portfolio in line with the semi-annual review of iEdge S-REIT Leaders Index this month. Below is the updated REIT+ constituent

Just published a very simple Singapore Savings Bond (SSB) tracker page here. Basically just sharing some data and charts derived from SSB info from MAS website. Hope you find it

I was back in Malaysia last weekend for a friend’s wedding when I saw the usual news of Singaporeans queuing for 4 hours for something. I thought it was for

If you thought that the Singapore Straits Times Index (STI) represented the top Singapore companies, news of Emperador’s addition here might have caught you by surprise. Emperador (SGX:EMI) is a