Based on allotment results for SSB Jan 2023, demand for SSBs are unwinding. This round, SSB was only oversubscribed by a hair (around 1% oversubscribed only). Most people got fully

Category: Bonds

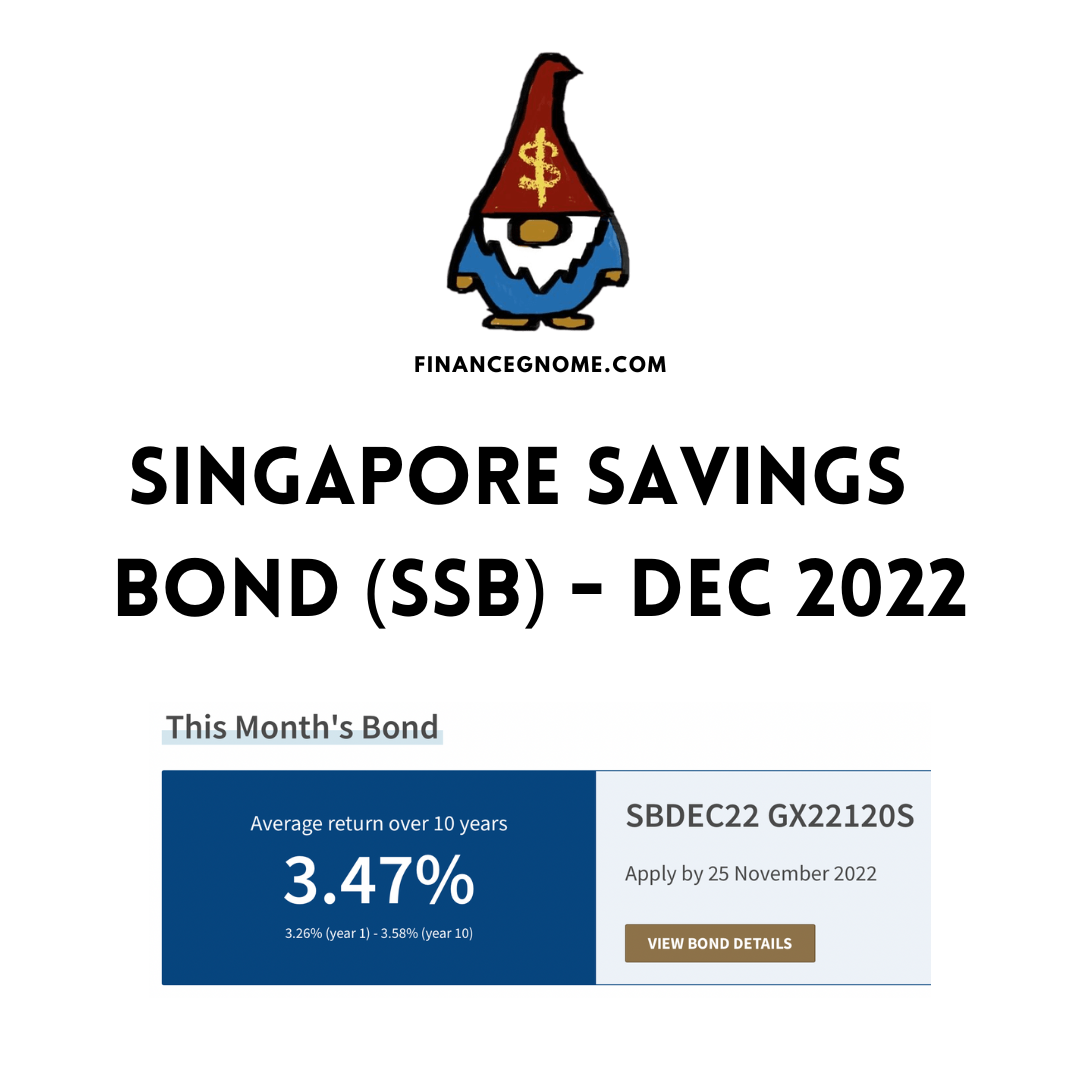

With so many compelling options to park cash right now yielding around 4%, holding onto previous SSB tranches yielding below 3% comes at an opportunity cost. Even this month’s SSB

Singapore Government Securities (SGS) 10-year bond yields, of which Singapore Savings Bond (SSB) yields are based upon, have resumed their fall so far in Dec 2022 and have recently sunk

With stocks in decline for a year now and both savings accounts and bonds yields increasing, there’s little incentive to take higher risks in the stock market. Naturally, interest in

Wow! Everyone gets up to $14k allotment for Dec SSB despite the yield hitting record highs. Imagine my surprise that demand has cooled quite a bit, although still oversubscribed by

10-year SGS bond yields have been falling since U.S. Oct CPI was reported on 10th Nov 2022, as expectations of the Fed slowing interest rate hikes has increased. 10Y SGS

Yet another record high for Dec 2022 SSB of 3.47% average 10-year yield! Even the first year yield is a juicy 3.26%. If you’re looking for places to park your

SSB Nov 2022 allotment results are out. Demand was high unsurprisingly, with this round being oversubscribed by more than 2x. Everyone who applied gets at least $10K. The lucky 29%

Nov 2022 SSB has hit another high so far this year of 3.21% average 10-year yield! The SSB yield curve has continued to flatten, with first year yield at 3.08%.

Just published a very simple Singapore Savings Bond (SSB) tracker page here. Basically just sharing some data and charts derived from SSB info from MAS website. Hope you find it