Competition for capital guaranteed products appears to be heating up, with the most recent update from StashAway to their Simple Guaranteed product. StashAway is now offering more tenure (they call

Author: Calvin Lo

The latest SSB for October 2023 has a 10-year average yield of 3.16%, higher than September SSB offering 3.06%. The first year yield is 3.05%, and subsequently the yield remains

In August, the fate of the so-called “Magnificent Seven” has begun to diverge. Nvidia (NVDA), Amazon (AMZN), and Alphabet (GOOG) have far outperformed Apple (AAPL), Microsoft (MSFT), Meta Platforms (META),

Singapore robo-advisors Syfe, Endowus, and StashAway have reported their Q2 and H1 2023 performance. Let’s see how they stacked up against each other, and who came out on top. In

After strong June, both portfolios have taken a bit of a breather in July. However, the S&P 500 and Nasdaq 100 continued to power on, rising 2.8% and 3.6% respectively,

The latest SSB for August 2023 has a 10-year average yield of 2.99%, substantially higher than last month’s SSB offering 2.82%. The first year yield is 2.97%, and subsequently the

Will this new bull market continue to rally? Or will we go into recession caused by high inflation and high interest rates? In this video, I share about how I’m

June has been another good month for the portfolios, both of which outperformed the S&P 500 and Nasdaq 100. Looking at the 1-month S&P 500 heat map from Finviz, the

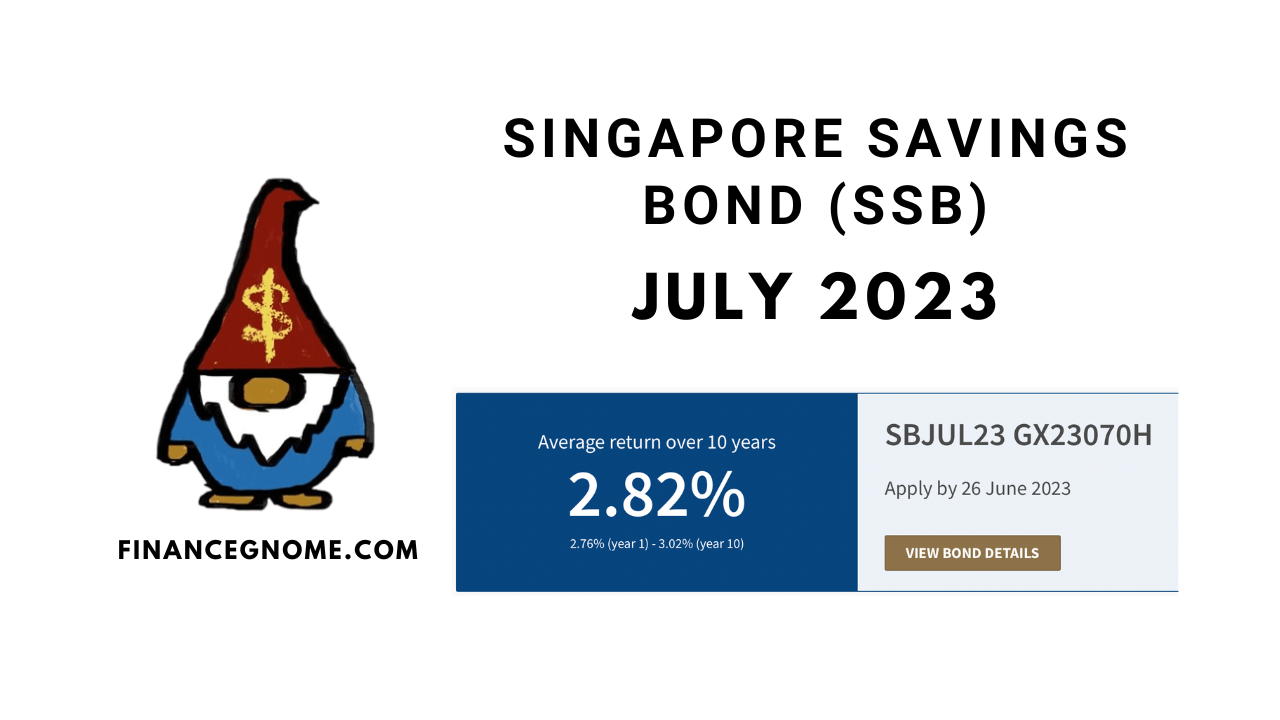

The latest SSB for July 2023 has a 10-year average yield of 2.82%, only marginally higher than last month’s SSB offering 2.81%. The first year yield is 2.76%, and subsequently

If you’re investing in stocks based mainly for its dividend yield or dividend growth, thinking that there’s a margin of safety or prices can’t go lower, I challenge you to